One of the most challenging parts of personal finance is figuring out what to do with our limited resources. If you’re working, you’re earning a certain amount each paycheck and need to decide how to allocate that money. How much goes toward necessities? How much to discretionary expenses? How much should you save for short-term goals? How much for longer-term goals and retirement? The list goes on and on.

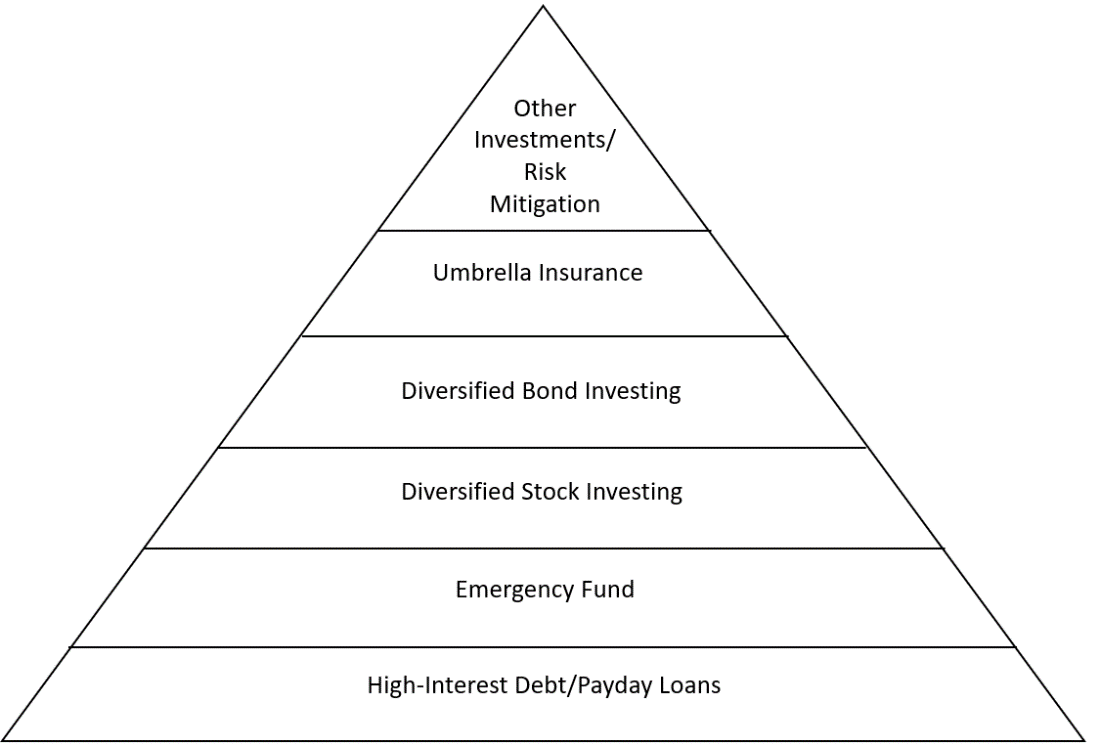

When managing your limited resources, it’s important that you set up a solid foundation. When thinking of foundations, what often comes to mind is the shape of a pyramid. The long, wide base needs to be started first before moving upward to the peak. If you start building out of order—if you flip the pyramid on its head—instead of having a strong, steady structure, you’re building a top that may spin precariously out of control. In the example of the food pyramid, if the foundational building block of your diet is processed foods instead of whole grains, fruits, and vegetables, you’re setting yourself up for health problems down the road.

Depending on where you are on your financial journey, you may be above the first levels of the pyramid. It’s also important to note that depending on your personal situation and goals, the ranges of these bands may differ or not apply at all. The purpose of the resource allocation pyramid is to provide things to consider and a rough framework for where to allocate dollars as your wealth grows.

The First Level: High-Interest Debt/Payday Loans

If you’re reading this blog, chances are you’re well past this first level. But everyone needs to start somewhere, and it’s important to start with the fundamentals. As financial planners, we often get asked about investments because they’re more fun and exciting than cash flow and resource allocation. But rarely are investments the first step in a solid financial plan. If you’re currently stuck paying high-interest debt (like credit cards) or are making ends meet through payday loans, your first priority should be paying this debt off.

It’s nearly impossible to become financially secure and build your net worth if you’re weighed down by these types of debt. If you are, then investments should be the last thing on your mind. It’s unrealistic to expect any investment return to exceed the high interest rate of credit cards or the exorbitant fees from payday loans. Get out of this debt first, and then you can start building from there.

The Second Level: Emergency Fund

Once you’re out of the high-interest debt, the next step is to make sure you never need to rely on these sources for cash flow again. One of the best ways to safeguard yourself is to have an emergency fund in place. When something comes up—and something will come up—having cash set aside for these very situations can prevent you from relying on a credit card balance to get through. The general rule of thumb is to have about three to six months’ worth of expenses set aside.

The Third Level: Diversified Stock Investing

Once you’re out of high-interest debt and have an emergency fund in place, now you can start focusing on investing. Of course, each person is going to be in a different situation and have different goals. So, although we’re talking about stock investing now, if you’re pursuing multiple goals simultaneously—like saving for a house down payment and retirement—you won’t want to allocate all of your excess cash flow to the stock market. As we’ve seen this year, the stock market can and does drop in value in the short term. The last thing you’d want is for your house down payment fund to significantly lose value right when you want to use it. But for longer-term savings, like for retirement, after you’re past the first two levels, now is a good time to start investing for your future.

The key term in this level, though, is “diversified.” There is a big difference between buying individual stocks and investing in a diversified fund that contains hundreds or even thousands of stocks. The stock market is unpredictable. Few individuals or teams have been able to consistently outperform the stock market over the long term—so few that usually only a few big names come to mind: Warren Buffett, Peter Lynch, Benjamin Graham . . .

Because this is so difficult to do, it’s highly unlikely you or I will be added to the list of these famed investors. This is why buying individual stocks is akin to gambling, while buying diversified funds is investing. Although past performance does not guarantee future results, historically the stock market as a whole (not necessarily individual companies) has produced returns that have exceeded inflation over the long term. That’s why, for longer-term goals, it usually makes sense to start allocating some of your resources to diversified stock investing once your financial bases are shored up.

The Fourth Level: Diversified Bond Investing

When financial planners talk about diversified investment portfolios, they are usually referring to a portfolio that includes both stocks and bonds. So why in the pyramid of resource allocation are these two assets split? This is because the role of bonds in a typical investment portfolio is to provide stability. Up to a certain point, the “stability” portion of someone’s financial plan can be made up of cash flow instead of an investment like bonds. This is how cash flow may work temporarily as the “bond” portion of someone’s portfolio:

Mike is getting his financial life in order. He no longer carries a credit card balance month to month, and he has an emergency fund with four months’ worth of living expenses. He is now ready to start saving for his retirement and is able to allocate $1,000 a month to invest. In the first month, he will add $1,000 to a diversified stock fund. With the anticipation of having $1,000 of excess cash to invest next month, his breakdown of stocks to stable assets (cash to invest) is 50/50 ($1,000 in stocks and $1,000 of extra cash). The stock market doesn’t move, and the next month, Mike invests another $1,000, so his new anticipated breakdown is $2,000 in stocks and $1,000 of expected cash (66% stocks and 33% “bonds”). As Mike continues to invest each month, the allocation of stocks will continue to increase, and his excess cash flow will make up a smaller percentage of his portfolio.

In the example above, since Mike is just starting out, he can use his excess cash flow to simulate the bond portion of his portfolio. When the excess cash flow makes up a smaller percentage, then it may make sense to start allocating between stocks and bonds, depending on what his target allocation is.

Another reason someone may not necessarily need bonds in their portfolio right away is because large percentage declines in the stock market don’t have as much impact early on. As we’ve seen this year, the stock market can and does drop in value—sometimes significantly. At points this year, the S&P 500 was down over 20% from its recent highs. If someone has $10,000 in an S&P 500 fund and it drops 20%, their portfolio drops to $8,000—a $2,000 loss. In the example above, if Mike is contributing $1,000 a month, he’s able to continue to buy stocks at a “discount” and hasn’t “lost” (you only really lose if you sell) much money in real dollar terms. Compare this to someone who is approaching retirement and has $1,000,000 invested. The same 20% decline is $200,000 in dollar terms.

Generally speaking, a portfolio that includes high-quality diversified bonds would have a smaller percentage—and thus dollar value—decline. In addition, if the stock market stays down for some time, having alternative assets to pull from, like bonds, allows someone who is retired to sell these investments instead to supplement their cash flow, allowing their stock portion to recover, as it historically always has.

While we split out investing in diversified stocks and bonds into different levels, is it necessarily wrong for someone starting out to lump them together? No. There are many different ways to start investing, and depending on your goals, time frame, and risk tolerance, some of these levels may be combined. Just because each layer of a pyramid builds on top of the previous one doesn’t mean the construction crew won’t start the scaffolding for the next layer before the lower one is completely finished.

The Fifth Level: Umbrella Insurance

So far, we’ve reviewed cash flow/budgeting-related items and investments. But as you move up this pyramid, asset protection becomes an important factor. Lower down the levels, and arguably at the very beginning, certain insurance should already be established. This includes making sure you have health, home, and auto insurance, and if you’re working, usually you should have disability insurance as well. Similar to having an emergency fund, having proper insurance in place will help protect you and prevent a serious financial setback if you experience an accident.

However, once you’ve started accumulating assets, another piece of insurance to seriously consider is umbrella coverage. Umbrella insurance is coverage that layers on top of the stated limits on your home and auto policies. If you file a claim, your home and auto policy limits will be used first. However, if the claim is greater than the limits on these policies, you’re left with having to pay the difference out of pocket. If you have umbrella coverage and the claim is eligible, and you exceed the limits on your standard policies, the umbrella coverage will then step in, up to your umbrella coverage limit, before you owe anything out of pocket.

This coverage is after the investment level of the pyramid because while you’re accumulating assets, the risk of serious litigation against you is usually low (unless you work in certain fields like medicine, law, construction, etc.). The risk is lower because you have fewer assets to lose.

The risk dynamic changes drastically when you’ve accumulated a nest egg that totals in the hundreds of thousands or millions of dollars. In that scenario, there is real risk that a serious lawsuit can completely wipe you out with little to no chance to fully recover. That’s why, generally speaking, it’s strongly recommended to have umbrella coverage in addition to your standard policies.

Usually, you should begin to consider umbrella coverage once your net worth reaches $500,000 (and possibly even before that), and anyone with a net worth over $1,000,000 should almost certainly purchase coverage. But, just like everything in personal finance, the right amount for you will depend on your risk tolerance and personal situation. Compared to other types of insurance, umbrella coverage is typically inexpensive (maybe a few hundred dollars annually for a $1,000,000 policy), but it’s not free. Increasing the policy limit and being at higher risk (having young drivers on your auto policy, owning a pool, etc.) will make the policy cost more.

As a rule of thumb, it often makes sense to get an umbrella policy that approximates your net worth. But as mentioned before, depending on your personal situation and risk tolerance, it may make sense to have a policy that is more—or less—than that.

The Final Level: Other Investments

We’ve made it. We’ve climbed to the top of the pyramid, where the world is your oyster. Here, you’ve afforded yourself the flexibility to hedge against more unusual scenarios or take some additional risks with your investments. The obvious reason this stage is last is because you’ve built a solid foundation. You’re sheltering yourself from short-term setbacks with an emergency fund. You’re investing prudently for the future through diversified stock and bond investments. You’re also protecting yourself from more common financial risks by having proper insurance in place, which likely includes an umbrella policy.

Since the pinnacle of the pyramid is the smallest part and the foundation is sound, if things go wrong here, it won’t topple the whole structure. If you have a hunch that XYZ company is going to the moon, you can put a small percentage of your assets into it. If things don’t turn out as planned, you’ll still be OK.

Once you reach this stage, you can also, if desired, hedge yourself against more remote risks. As financial planners, much of what we do for risk mitigation revolves around probabilities. For instance, we know that the stock market historically has produced long-term returns that exceed inflation, but also that it is volatile in the short term. Because of that, we construct diversified portfolios that include bonds and cash. Another example is that we know that a significant portion of people will need long-term care for some period of time during their lives. So, we review options for this care, which include self-insuring, buying long-term care insurance, using family caregivers, Medicaid planning, or a combination of these. We also know that saving enough for retirement is a top concern for most people, so we recommend consistent, steady savings over someone’s lifetime, rather than trying to hit speculative home runs in the ninth inning.

We focus on these risks because they are the most likely. But that does not mean remote risks or black swan events can’t or don’t happen. When something has a very low chance of occurring, many times it does not make sense to spend a lot of time, money, or effort hedging against these potential anomalies when most people have concerns about funding their retirement during “normal” circumstances.

At this final level, you’ve earned the right to hedge against these remote risks if you so choose, because you’ve taken care of the more likely ones. Once you have a solid foundation in place, you can play at the edges by holding larger cash balances than necessary by traditional planning standards or play with a small sandbox investment account for alternate investments, with the understanding that if your investment falls to zero, you still have your secure base of the pyramid to hold you up.

Of course, you can always continue to save and invest as you did in the lower levels. That’s not a wrong answer either. At the top of the pyramid, when everything else is covered, there really aren’t any “wrong” answers. You get to choose.

Wrap-Up

When building any stable structure, you need a solid foundation, and finance is no different. Having a strong financial foundation allows you to better reach your goals and helps avoid any major setbacks when life inevitably throws curveballs your way. While investments are one of the top areas people want to talk about, there are other building blocks that should be squared away before diving in.

Having a strong foundation doesn’t just set you up for long-term success; it also provides the flexibility to explore alternative investment options without derailing your overall plan. Too often, people flip the pyramid on its head and focus on trying to hit home runs with speculative investments rather than getting their bases squared away first. The better answer is to establish a solid foundation and then allocate a small percentage to more speculative investments if you so choose.

If you need help reviewing your overall financial plan, please reach out to our team .

This is not to be considered tax or financial advice. Please review your personal situation with your tax and/or financial advisor. All advisors at Milestone Financial Planning, LLC, a fee-only financial planning firm in Bedford, NH. Milestone work with clients on a long-term, ongoing basis. Our fees are based on the assets that we manage and may include an annual financial planning subscription fee. Clients receive financial planning, tax planning, retirement planning, and investment management services, and have unlimited access to our advisors. We receive no commissions or referral fees. We put our clients’ interests first. If you need assistance with your investments or financial planning, please reach out to one of our fee-only advisors .