Author: Jonathan Harrington

President Biden is planning on previewing his American Families Plan (AFP) at his first address to a joint session of Congress on April 28th. Some of the expected parts of the plan include extending the enhanced child tax credit, 12 weeks of family leave paid for by the federal government, free community college, access to free childcare, and universal pre-K.

To pay for all of these new programs, the President is expected to propose tax increases in various forms. One of the most talked-about changes is with long-term capital gains rates, reportedly increasing dramatically for those Americans with more than $1 million in taxable income.

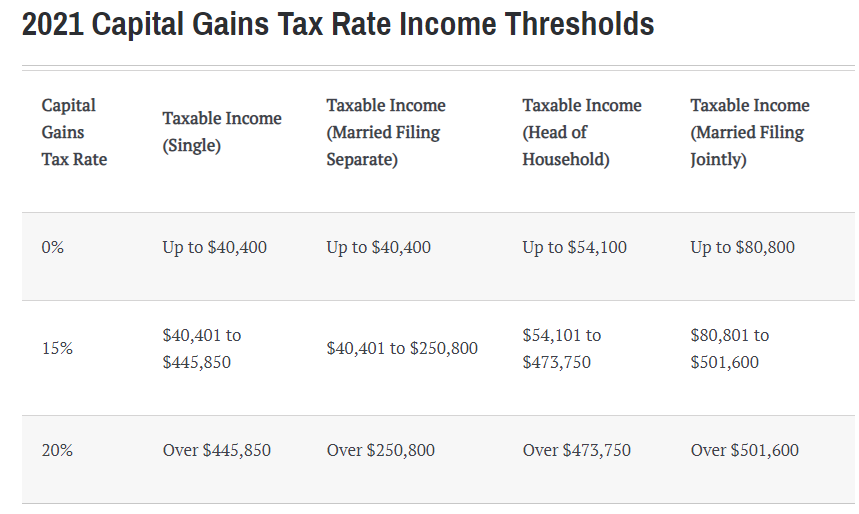

Today’s capital gains rates range from 0% to 20% depending on the amount of your taxable income (see chart below). The expectation is that the AFP will eliminate the preferential tax treatment for capital gains and qualified dividends for taxpayers with taxable income of $1 million or more. Instead, these taxpayers will pay regular income tax rates on their capital gains. The AFP will ALSO propose changing the marginal income tax rates that would apply to capital gains for these high earners back to the previous top rate of 39.6% (today it is 37%).

Note: It isn’t clear if the $1 million threshold will apply to each person or collectively, i.e. the threshold for married filing joint filers may be $2 million.

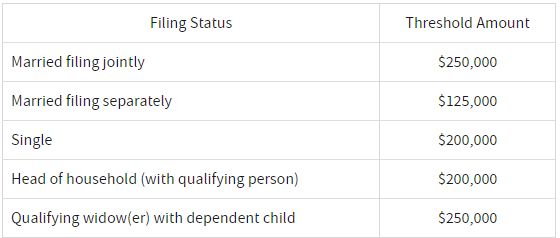

When combined with the net investment income tax surcharge of 3.8% on net investment income (taxable interest, dividends, capital gains, passive rents, annuities, and royalties) which applies to modified adjusted gross income over the thresholds below, the total tax on capital gains will top out at 43.4%. Considering the current maximum capital gains rate is 23.8%, that is an 82% increase!

Net Investment Income Tax Thresholds

What does this mean for investors? Well, it depends on your perspective. If you do not expect to have $1 million in taxable income at any point in the future, then you don’t have to worry about it. And note that this change affects less than 0.3% of all taxpayers (but see side note #2, below). If you think there will be a year or years in your future where your taxable income will exceed $1 million, there are ways you can avoid and/or reduce your exposure to the increased capital gains tax.

- Don’t sell assets with unrealized gains: The easiest way to avoid a capital gain is to not sell the asset and defer the sale into a year where your taxable income is under the $1 million threshold.

- Sell the asset over time : If selling the asset itself would be the reason that you exceed the $1 million threshold, sell it over time in an installment sale or if it is a security, in smaller quantities.

- Remember the personal residence capital gains exclusion : Up to $250,000 for single filers and $500,000 for married filers of capital gains on the sale of a personal residence can be excluded from income.

- Donate highly appreciated stock to charity or a Donor Advised Fund (DAF) : If you are charitably inclined, you can donate your highly appreciated securities (better bang for the buck) to charity or a DAF and reduce your taxable income (subject to itemized deduction limitations-see Side note #3 below).

- Rebalance in tax-advantaged accounts : If it is possible, in the years that your income exceeds $1 million avoid capital gains from your taxable investment accounts by rebalancing your portfolio with securities that are held in your tax-advantaged retirement accounts (such as regular or Roth IRAs)

- Reduce RMDs with QCDs : If part of the reason that you are exceeding $1 million is due to large required minimum distributions you may consider making Qualified Charitable Distributions. Each dollar of your RMD that you make to charity reduces your adjusted gross income and if your taxable income is close to $1 million this could bring you back under the threshold.

- Frontload capital gains in 2021 : To the degree that it makes sense, consider pushing up sales of assets into 2021 to take advantage of lower rates while they are still available. (This assumes the tax changes will be effective 1/1/2022, which is not assured).

Side Note #1 : There is another proposal to do away with the step-up in basis for inherited assets. If that is included with the AFP, it brings a whole new set of planning challenges and opportunities concerning capital gains.

Side Note #2 : There are years in which individuals may be subject to this tax. If you sell a small business, rental property, other real estate, or personal residence with a very large capital gain, and your combined income > $1M that year, you may be subject to these taxes.

Side Note #3 : There is yet another proposal to limit itemized deductions for taxpayers earning more than $400,000. If this happens, it could reduce the benefits of making charitable contributions to reduce taxable income. Also, non-cash deductions are generally limited to 30% of your Adjusted Gross Income.

Some pundits say that a higher capital gains tax will lead to massive security liquidation and a resulting market crash. This theory assumes that investors harvesting gains would sell a security and then not reinvest the proceeds. That doesn’t make sense. On top of that, this new rule would only affect a sliver of individual investors and doesn’t affect institutional investors, endowments, tax-advantaged assets in retirement accounts, etc.

The bottom line is that the AFP is still just a proposal that will undoubtedly be changed as it makes its way through Congress. It is important to be aware of what might be coming so you can start considering planning opportunities. Even if the capital gains tax increases and you happen to be affected by it, there are ways that you can mitigate the impact.

Jonathan Harrington, CFP® is an advisor at Milestone Financial Planning, LLC, a fee-only financial planning firm in Bedford NH. Milestone works with clients on a long-term, ongoing basis. Our fees are based on the assets that we manage and may include an annual financial planning subscription fee. Clients receive financial planning, tax planning, retirement planning, and investment management services, and have unlimited access to our advisors. We receive no commissions or referral fees. We put our clients’ interests first. If you need assistance with your investments or financial planning, please reach out to one of our fee-only advisors .